Related ACM UPDATE: Bank Of America Reiterates On AECOM Technology On URS Acquisition News Top Performing Industries For July 15, 2014

Related ACM UPDATE: Bank Of America Reiterates On AECOM Technology On URS Acquisition News Top Performing Industries For July 15, 2014 U.S. stocks fell as the Dow dipped below the 17,000 marks as geopolitical concerns become a main focus.

In a televised statement, President Obama said the United States will expand on sanctions meant to hurt Russia's energy, defense and financial sectors.

The move follows Russia's continued support of separatists in Ukraine and a militarized presence on its own border with Ukraine.

In the Middle East, Israel continues its offensive to root out terrorists, as a near-term solution appears to be less likely.

Recommended: 4 Things Every Beginning Trader Should Know

The Dow lost 0.42 percent, closing at 16,912.11. The S&P 500 lost 0.45 percent, closing at 1,969.95. The NASDAQ lost 0.05 percent, closing at 4,442.70. Gold lost 0.21 percent, trading at $1,300.60 an ounce. Oil lost 0.81 percent, trading at $100.85 a barrel. Silver gained 0.35 percent, trading at $20.64 an ounce.News Of Note

ICSC Retail Store Sales rose 4.6 percent year over after rising 2.8 percent last week.

S&P Case-Shiller Home Price Index declined by 0.3 percent in May, falling short of forecasts for a gain of 0.2 percent. Non-seasonally adjusted prices rose 1.1 percent, lower than expectations of a 1.5 percent rise.

Redbook Chain Store Sales rose 3.0 percent year over year after rising 3.7 percent last week.

July Consumer Confidence rose to 90.9 from 86.4 in June. Analysts were expecting July's reading to be 85.5.

A group of Argentina's creditors have offered to waive their rights upon future offers clause that was included in the original bond contracts. This could potentially help Argentina reach a deal with holdout bond investors before Wednesday.

The European Union will introduce new sanctions that target four of Russia's economic sectors: finance, dual-use equipment that could potentially be converted to military applications, arms as well as oil production equipment.

Analyst Upgrades And Downgrades Of Note

Analysts at Credit Suisse maintained an Outperform rating on Cummins (NYSE: CMI) with a price target raised to $167 from a previous $161. Shares lost 1.14 percent, closing at $143.70.

Analysts at Deutsche Bank maintained a Hold rating on Darden Restaurants (NYSE: DRI) with a price target lowered to $44 from a previous $49. Shares gained 4.36 percent, closing at $46.88.

Analysts at S&P Capital IQ upgraded Deutsche Bank (NYSE: DB) to Buy from Hold. Shares lost 0.50 percent, closing at $35.69.

Analysts at BMO Capital downgraded Dollar Tree (NASDAQ: DLTR) to Market Perform from Outperform with a price target lowered to $59 from a previous $69. Also, analysts at Jefferies maintained a Hold rating on Dollar Tree with a price target raised to $56 from a previous $51. Shares lost 0.78 percent, closing at $54.44.

Analysts at UBS maintained a Buy rating on EMC Corp (NYSE: EMC) with a price target raised to $33 from a previous $32. Shares lost 0.67 percent, closing at $29.47.

Analysts at Argus Research maintained a Buy rating on Eli Lilly and Company (NYSE: LLY) with a price target raised to $72 from a previous $64. Shares lost 0.98 percent, closing at $62.77.

Analysts at Piper Jaffray upgraded Family Dollar (NYSE: FDO) to Neutral from Underweight with a price target raised to $74.50 from a previous $50. Shares lost 1.64 percent, closing at $74.50.

Recommended: A Resources ETF With An Upstream Emphasis

Analysts at JPMorgan maintained an Underweight rating on Garmin (NASDAQ: GRMN), with a price target raised to $51 from a previous $50. Shares gained 0.10 percent, closing at $57.58.

Analysts at Piper Jaffray downgraded Horizon Pharma (NASDAQ: HZNP) to Neutral from Overweight with a price target lowered to $9 from a previous $22. Shares lost 9.67 percent, closing at $8.27.

Analysts at Sterne Agee initiated coverage of St. Jude Medical (NYSE: STJ) with a Neutral rating and $74 price target. Shares lost 1.09 percent, closing at $66.03.

Analysts at KeyBanc maintained a Buy rating on Tyson Foods (NYSE: TSN) with a price target raised to $48 from a previous $46. On the other hand, analysts at Credit Suisse maintained an Underperform rating on Tyson Foods with a price target raised to $38 from a previous $35. Shares lost 3.43 percent, closing at $39.17.

Analysts at Goldman Sachs downgraded Wal-Mart (NYSE: WMT) to Neutral from Buy. Shares lost 0.36 percent, closing at $75.44.

Equities-Specific News Of Note

Citigroup (NYSE: C) plans to hire 100 bankers for its commercial banking services in Asia-Pacific and target potential clients that could generate annual sales of $10 million to $500 million. Shares lost 0.56 percent, closing at $49.42.

BlackBerry (NASDAQ: BBRY) has agreed to acquire Secusmart, a German maker of mobile encryption and security. Shares lost 4.42 percent, closing at $9.51. Separately, Ford announced that it replace around 3,300 of its employees' BlackBerry phones with iPhones by the end of the year. In total, Ford will replace nearly 6,000 of its employees BlackBerry phones with iPhones over the next 24 months. Shares of BlackBerry lost 4.42 percent, closing at $9.51.

Authorities in China are investigating Microsoft (NASDAQ: MSFT) over anti-monopoly concerns. China's State Administration for Industry & Commerce noted that Microsoft did not fully disclose information regarding its Windows operating system as well as Office applications. Shares lost 0.19 percent, closing at $43.88.

Electronic Arts (NYSE: EA) announced a new subscription service that will be exclusive for the Xbox One. Subscribers will be granted unlimited access to many of Electronic Arts' games for $4.99 a month or $29.99 a year. Shares lost 2.14 percent, closing at $34.34.

Apple (NASDAQ: AAPL) announced new lower prices on its MacBook Pro lineup, which also features faster CPUs and more RAM. Shares hit new 52-week highs of $99.44 before turning negative and closing the day at $98.38, down 0.65 percent.

Jana Partners wrote a letter to PetSmart (NASDAQ: PETM) blasting the company's decision to skip a review of potential acquirers and explore a recapitalization plan instead. Shares lost 0.33 percent, closing at $70.23.

Chesapeake Energy (NYSE: CHK) announced it will buy back all outstanding preferred shares issued by its Utica unit for $1.26 billion to simplify its balance sheet as well as eliminate $75 million in annual dividend payments. Shares gained 0.82 percent, closing at $27.06.

Caterpillar (NYSE: CAT) will purchase $2.5 billion of its common stock under an accelerated stock repurchase transaction. Shares gained 0.52 percent, closing at $104.69.

Recommended: Strong Retail Data And Wal-Mart Downgrade Could Fuel Volatility In This ETF

Aecom Technology (NYSE: ACM) has acquired Hunt Construction for an undisclosed sum. This marks Aecom's second large acquisition in the span of two weeks. Shares lost 0.32 percent, closing at $34.72.

Winners Of Note

Windstream (NASDAQ: WIN) announced it plans to spin off its fiber and copper networks in addition to other real estates into a new publicly traded REIT. The company's board of directors approved the plans following a favorable letter ruling from the IRS, which leads management to the belief that it can reduce its debt by $3.2 billion and free up cash flow to invest in broadband. Following the spin-off the company will issue a $0.70 per share dividend with $0.60 coming from the REIT. Shares hit new 52-week highs of $13.30 before closing the day at $11.83, up 12.35 percent.

All six of Casablanca Capital's nominees have been elected to Cliff Natural Resources' (NYSE: CLF) board of directors, including Lourenco Goncalves who is considered a likely replacement to the company's current CEO Gary Halverson. Shares gained 6.21 percent, closing at $17.62.

Decliners Of Note

This morning, Eaton (NYSE: ETN) reported its second quarter results. The company announced an EPS of $0.41, missing the consensus estimate of $1.14. Revenue of $5.77 billion missed the consensus estimate of $5.79 billion. Net income for the quarter fell to $172 million from $497 million in the same quarter a year ago despite sales rising three percent from a year ago, including a six percent rise in electrical product sales and nine percent rise in aerospace. The company lowered the high end of its fiscal 2014 guidance and now sees its EPS being in a range of $4.50 to $4.70, down from a previous $4.50 to $4.90. The company noted that the lower guidance reflects lower margins in its electrical systems and services segment. During the conference call, the company noted that it does not see any compelling reason to transform its portfolio, as it will face a large tax liability if it were to spin off a division within five years of its Cooper Industries acquisition. Shares lost 8.13 percent, closing at $70.51.

This morning, Corning (NYSE: GLW) reported its second quarter results. The company announced an EPS of $0.37, missing the consensus estimate of $0.38. Revenue of $2.58 billion missed the consensus estimate of $2.53 billion. Net income for the quarter fell to $169 million from $638 million in the same quarter a year ago as Gorilla Glass sales fell short of expectations and remained flat from a year ago at $298 million because of soft retail demand. The company also noted it is seeing lower than expected sales for planned new smartphones and tablets. The company did see its LCD glass division sales rise 62 percent form a year ago to $1.1 billion because of its agreement with Samsung. Optical communications sales rose 14 percent to $601 million, while environmental technologies sales rose 25 percent to $285 million. Corning issued guidance and sees its third quarter LCD glass volume rising by a mid-single digit percentage point with price declines moderating further. Optical sales will grow by a mid-single digit while environmental sales will rise 20 percent to 25 percent. Shares lost 9.30 percent, closing at $20.00.

Men's Wearhouse (NYSE: MW) disclosed during its Analyst Day presentation that it sees its comp growth being in a range of two percent to three percent through 2017, while gross margins will improve 150 bps to 200 bps as sales are expected to top $3.7 billion by 2017. The company also said that expectations of merger synergies is pushed back because of some potential inventory issues. Shares lost 9.89 percent, closing at $51.66.

Earnings Of Note

This morning, Level 3 Communications (NASDAQ: LVLT) reported its second quarter results. The company announced an EPS of $0.37, beating the consensus estimate of $0.30. Revenue of $1.63 billion beat the consensus estimate of $1.60 billion. Net income for the quarter rose to $51 million from a net loss of $24 million in the same quarter a year ago as the company saw its Core Network services revenue grow 6.9 percent to $1.479 billion, as sales grew in Latin America and North America. At the end of the quarter the company noted it had $1.143 billion in differed revenue, up from $1.132 billion at the end of the same quarter a year ago. The company noted that it remains confident in its performance for the rest of the year and reiterated its full year fiscal 2014 outlook. Shares hit new 52-week highs of $49.22 before closing the day at $46.18, up 2.83 percent.

Recommended: 3 More Homebuilder Stocks To Watch Ahead Of Earnings

This morning, Merck & Co (NYSE: MRK) reported its second quarter results. The company announced an EPS of $0.85, beating the consensus estimate of $0.85. Revenue of $10.93 billion beat the consensus estimate of $10.60 billion. Net income for the quarter rose to $2.00 billion from $906 million in the same quarter a year ago despite total sales declining one percent reflecting unfavorable impact of patent expires, divested products and decline in sales of Hepatitis C products. The company's largest segment by revenue (Pharmaceutical) saw its sales decline by two percent to $9.087 billion because of the ongoing impact of the loss of market exclusivity for TEMODAR and NASONEX. Merck issued guidance and sees its EPS being in a range of $4.44 to $4.77 and revenues to be between $42.4 billion to $43.2 billion. Shares gained 1.05 percent, closing at $58.58.

This morning, Pfizer (NYSE: PFE) reported its second quarter results. The company announced an EPS of $0.58, beating the consensus estimate of $0.57. Revenue of $12.773 billion beat the consensus estimate of $12.50 billion. Net income for the quarter fell to $14.095 billion in the same quarter a year ago mainly related to its spin-off of its animal-health unit into a new entity named Zoetis. The company saw its pharmaceutical segment revenue fall six percent to $6.5 billion because of generic competition. Sales of innovative pharmaceutical products fell five percent to $3.5 billion because of the expiration of a co-promotion agreement for Enbrel in the U.S. and Canada. Revenue from the company's vaccine unit rose 13 percent to $1.1 billion, while oncology medicines saw its sales rise 16 percent to $570 billion. Pfizer revised previous guidance and sees its full year fiscal 2014 revenue being in a range of $48.7 billion to $50.7 billion from a previous guidance of $49.2 billion to $51.2 billion. GAAP EPS is now guided to a range of $1.47 to $1.62 from a previous $1.57 to $1.72. Shares lost 1.23 percent, closing at $29.73.

After the market closed, Buffalo Wild Wings (NASDAQ: BWLD) reported its second quarter results. The company announced an EPS of $1.25, beating the consensus estimate of $1.19. Revenue of $366.0 million beat the consensus estimate of $358.85 million. Shares were trading lower by 4.62 percent at $159.42 following the earnings release.

After the market closed, American Express (NYSE: AXP) reported its second quarter results. The company announced an EPS of $1.38, beating the consensus estimate of $1.37. Revenue of $8.70 billion beat the consensus estimate of $8.66 billion. Shares were trading lower by 0.01 percent at $91.70 following the earnings release.

After the market closed, Twitter (NYSE: TWTR) reported its second quarter results. The company announced an EPS of $0.02, beating the consensus estimate of -$0.01. Revenue of $312.0 million beat the consensus estimate of $282.82 million. Shares were surging higher by 29.90 percent at $50.13 following the earnings release.

After the market closed, United States Steel (NYSE: X) reported its second quarter results. The company announced an EPS of $0.34, beating the consensus estimate of $0.32. Revenue of $4.45 billion missed the consensus estimate of $4.51 billion. Shares were trading higher by 5.67 percent at $29.24 following the earnings release.

Quote Of The Day

“Russia is the largest oil- and gas-producing country on the planet, and the world is going to need 40 percent more energy between now and 2035. That's why you can see many, many, many international companies working in Russia.” - BP's CEO Bob Dudley, speaking of the dilemma imposed by sanctions on Russia.

Posted-In: aecomEarnings News Econ #s Economics After-Hours Center Markets Movers Best of Benzinga

© 2014 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Most Popular IPO Lookout: Busy Week Brings The Biggest IPO Since Facebook Earnings Expectations For The Week Of July 28: Exxon, Pfizer, Twitter And Much More Telecom Sector Shoots Higher On Unprecedented Windstream Announcement 5 Big Companies Seriously Investing In 3D Printing 3D Printing Stocks In Play After Amazon Announces Store Launch Earnings Scheduled For July 29, 2014 Related Articles (AAPL + ACM) Stocks Lower As Earnings Season Takes Back Seat To Geopolitical Uncertainties Apple Lowers Pricing On MacBooks Markets Little Changed Ahead Of The Federal Reserve's Policy Decision

) soared on Wednesday morning after the company beat third quarter estimates. The company reported earnings of $82 million, or 47 cents per share, down from $113 million, or 52 cents per share, last year. Excluding special items related to its Tyco separation, earnings were 55 cents per share, above analysts’ estimate of 47 cents per share.

) soared on Wednesday morning after the company beat third quarter estimates. The company reported earnings of $82 million, or 47 cents per share, down from $113 million, or 52 cents per share, last year. Excluding special items related to its Tyco separation, earnings were 55 cents per share, above analysts’ estimate of 47 cents per share. : After closing up 0.13% on Thursday, Amazon stock(Nasdaq: AMZN) plummeted more than 7.5% after hours when it reported a miss on its Q2 2014 earnings.

: After closing up 0.13% on Thursday, Amazon stock(Nasdaq: AMZN) plummeted more than 7.5% after hours when it reported a miss on its Q2 2014 earnings. So far this year, the company has already released a set top box, a wand for shopping with Amazon Pantry, a new, unlimited e-book subscription, and its own music streaming product. And today, Amazon will launch the Fire Phone, its first foray into smartphones. It connects simply and directly with Amazon's library of wares - videos, books, music, and apps - and it's the easiest way to buy merchandise from Amazon.com.

So far this year, the company has already released a set top box, a wand for shopping with Amazon Pantry, a new, unlimited e-book subscription, and its own music streaming product. And today, Amazon will launch the Fire Phone, its first foray into smartphones. It connects simply and directly with Amazon's library of wares - videos, books, music, and apps - and it's the easiest way to buy merchandise from Amazon.com.  MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  223.57 (1y: +66%) $(function(){var seriesOptions=[],yAxisOption

223.57 (1y: +66%) $(function(){var seriesOptions=[],yAxisOption

REUTERS

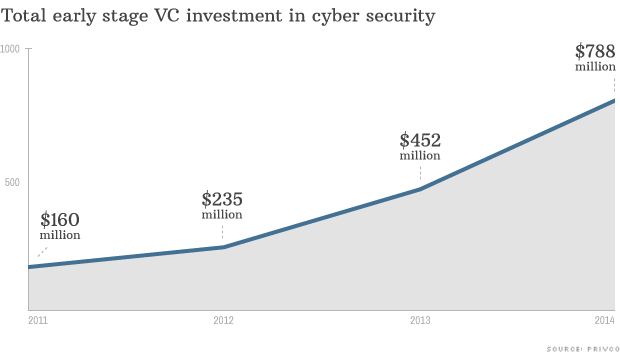

REUTERS  NEW YORK (CNNMoney) Online privacy is on the tips of everyone's tongues these days, and investors are rushing to pour money into cybersecurity startups.

NEW YORK (CNNMoney) Online privacy is on the tips of everyone's tongues these days, and investors are rushing to pour money into cybersecurity startups.

Popular Posts: 8 Biotechnology Stocks to Buy Now9 Oil and Gas Stocks to Buy Now10 Best “Strong Buy” Stocks — GMK TPL BITA and more Recent Posts: Hottest Financial Stocks Now – NBG GGAL BMA HDB Hottest Healthcare Stocks Now – HLS PBYI MD VRX Hottest Technology Stocks Now – MDRX SNX STX MITL View All Posts 7 Biotechnology Stocks to Buy Now

Popular Posts: 8 Biotechnology Stocks to Buy Now9 Oil and Gas Stocks to Buy Now10 Best “Strong Buy” Stocks — GMK TPL BITA and more Recent Posts: Hottest Financial Stocks Now – NBG GGAL BMA HDB Hottest Healthcare Stocks Now – HLS PBYI MD VRX Hottest Technology Stocks Now – MDRX SNX STX MITL View All Posts 7 Biotechnology Stocks to Buy Now  NEW YORK (CNNMoney) Americans are taking their medicine.

NEW YORK (CNNMoney) Americans are taking their medicine.