Alaska, Oregon, and Washington, D.C. all have November ballot measure initiatives regarding the legalization of recreational marijuana, passage of which would put them in the same company as Colorado and Washington state.

While time will tell for certain whether voters will embrace legalization of the wacky weed, the "pro" side of the question has emerged as much more vocal – and well-financed – than the "con" side, with high-profile and moneyed supporters working tirelessly to ensure the passage of Measure 91, Oregon's legal pot initiative.

Billionaires and celebrities weigh in

In the two years since Oregon voted down a legalized-pot measure, the two dominant pro-legalization groups, Drug Policy Action, and New Approach PAC, have been building their support base and padding their financial coffers. The first alliance sharpened its skills on the successful efforts in Colorado and Washington state, making good use of the large cash donations of hedge fund founder and philanthropist George Soros.

The billionaire investor has been active in the pro-legalization battle for many years, and has donated the better part of $200 million to the Drug Policy Alliance, the New York-based group with which Drug Policy Action is affiliated. The Alliance was heavily involved in drafting Measure 91, just as it helped write the ballot initiatives in Colorado and Washington state.

New Approach PAC is a more recent venture, spearheaded by the family of the late CEO of Progressive Corporation, Peter Lewis. Before his death late last year, Lewis had donated $96,000 to New Approach Oregon, and the new PAC has recently donated $300,000 to the effort to pass Measure 91. Lewis also donated more than $2 million to Washington state's legalization drive in 2012.

On the celebrity side, travel show host Rick Steves has been in Oregon on a 10-city speaking tour ahead of the Nov. 4 vote, using his worldly experience to promote a "yes" vote on the initiative. Steves sees legalization as a progressive political issue, noting that countries that decriminalize and regulate the drug are able to put public money otherwise spent on enforcement to better use.

Law enforcement officials speak out

Perhaps the most surprising supporters of Oregon's initiative are those involved in law enforcement – though, most are not presently working in that field, or living in Oregon.

Supporters who once had careers in law enforcement include a former U.S. Attorney for Oregon, a retired Oregon Supreme Court Justice, and a former county drug prosecutor – as well as a former county sheriff in the state of Oregon.

Perhaps the most high-profile official to lend his voice to the call for legalization is the current sheriff of King County in Washington state, John Urquhart. In a recent television spot, Urquhart doesn't tell Oregonians how to vote, but stresses that legalization in his state has freed up money for things like schools – without a commensurate rise in arrests for driving under the influence.

The TV ad is the third so far by the "Yes on 91" campaign, which has received $3.3 million from donors like Drug Policy Action and the New Approach PAC.

On the other side of the question is the "No on 91" camp, which has raised a little over $168,000. The bulk of the money, $145,000, came from the Oregon State Sheriffs' Association, while the Oregon Narcotics Enforcement Association kicked in $20,000. The main concern of the campaign, according to No on 91 Director Mandi Puckett, is that legalization will make weed more available to children.

Too close to call?

Though it looks as if the "ayes" should have it, the well-oiled machine of Yes on 91 may not have influenced public opinion enough to emerge victorious. The latest survey taken in October shows the pro-legalization side in the lead, though the percentage of undecided voters could conceivably turn the tide against legalization if enough of them were to cast ballots in opposition.

With the election right around the corner, both sides of the issue will likely push to win over still-undecided voters. So far, however, the outcome looks too close to call.

Top dividend stocks for the next decade

The smartest investors know that dividend stocks simply crush their non-dividend paying counterparts over the long term. That's beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor's portfolio. To see our free report on these stocks, just click here.

The most common homeowner complaint is that the house is too small. NEW YORK (CNNMoney) Big purchases often come with big expectations.

The most common homeowner complaint is that the house is too small. NEW YORK (CNNMoney) Big purchases often come with big expectations.

Getty Images The NYSE use to look like this. This is New York Mercantile Exchange.

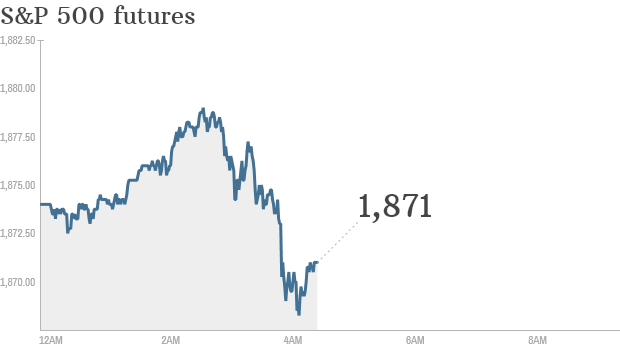

Getty Images The NYSE use to look like this. This is New York Mercantile Exchange.  Click chart for in-depth premarket data. LONDON (CNNMoney) There's plenty going on Wednesday. Let's get straight to it.

Click chart for in-depth premarket data. LONDON (CNNMoney) There's plenty going on Wednesday. Let's get straight to it.