About 1,000 workers at two of Amazon's German fulfillment centers went on strike Monday demanding a wage agreement similar to what's on offer elsewhere in the country's retail and mail-order sectors.

Officials at Ver.di, a big services union in Germany, warned that there may be more strikes during the holiday season unless Amazon negotiates -- something the company has said it does not plan do to.

Amazon's German business, its second largest after the U.S., has suffered from bouts of labor unrest since a TV documentary earlier this year showed seasonal workers brought in to help with the holiday rush being harassed by security guards.

Amazon quickly cut ties with the security firm in question and the company has defended the working conditions at its warehouses. However, the strike highlights the tension between Amazon's push for fast shipping and low prices and the experience of employees at its distribution centers.

The strike also sparked concern that Amazon may not be able to handle German customer orders as well this holiday.

"Amazon needs to make sure they have ample labor supply for the holiday rush," Colin Sebastian, an analyst at RW Baird, said.

The company is also in defensive mode in the U.K. after the BBC ran a TV program this week in which an undercover reporter worked at an Amazon fulfillment center there and ended a 10.5 hour night shift "absolutely shattered."

"We strongly refute the charge that Amazon exploits its employees in any way," the company said in a new section of its U.K. website which highlights the benefits of working in its fulfillment centers.

Amazon moved to a four-day, 10 hours-per-day, work week at its U.K. fulfillment centers recently. The company used to run on a five-day, 8 ! hour schedule.

An Amazon spokesman said the change was not made under pressure from critics of its warehouse work conditions. However, he said the move has been popular with warehouse workers because they get an extra day off and do not have to commute as much.

Amazon's approach to running its fulfillment centers is also coming under scrutiny in the U.S. Industry news website EcommerceBytes published a blog Tuesday from an unidentified person who it said got hired as a seasonal worker for three months at an Amazon warehouse in the U.S.

The person said that, despite regularly working out, they were unprepared for the physical challenge of working in a busy Amazon fulfillment center during the holidays.

"Now that we've gone to five 10 hr work days I've discovered my legs aren't in as good a shape as I thought," the person wrote. "By day two of this week my ankles are swollen and painful. By day four I'm down to the drug store talking about support stockings. I'm becoming concerned that standing for long hours on concrete floors is doing damage to my venous system."

Some newer seasonal workers have started to complain about the push for better production numbers from Amazon's floor managers, the person added in the blog.

"Many people have quit already." the person added. But on Monday another 60 or so new seasonal workers arrived for training, the person noted.

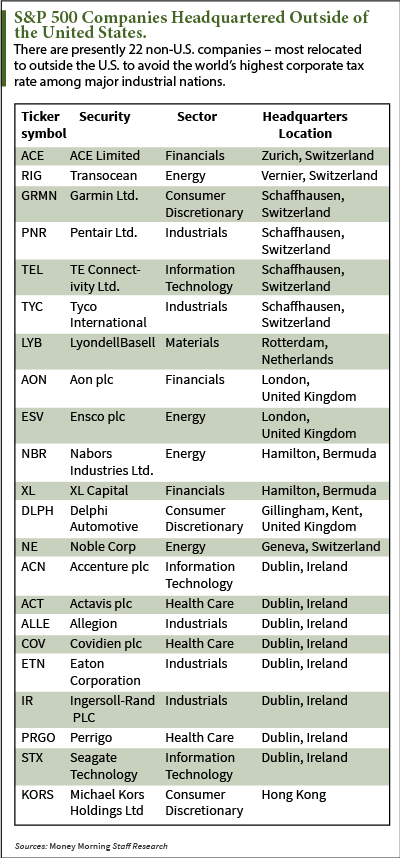

A tax inversion deal is a merger between a U.S and a foreign company specifically designed to allow the U.S. company to move its headquarters out of the United States to escape America's high corporate tax rate.

A tax inversion deal is a merger between a U.S and a foreign company specifically designed to allow the U.S. company to move its headquarters out of the United States to escape America's high corporate tax rate.

BlueOrange Studio/Shutterstock One day out of 365, we pay homage to our sainted mothers. Those of us who are members of this long-suffering, uncomplaining, self-sacrificing class may get some soggy French toast in bed, (don't worry, kids; mom will clean up the kitchen), a chance to read in peace, or perhaps time to indulge in a long, hot bath. Bringing Home the Bacon If you really want to pay back mom for all she's done, get ready to pony up big. A card and some carnations (the official flower of Mother's Day, who knew?) just won't cut it. The cost of replacing mom as nurturer, nurse, cleaner and cook -- according to Insure.com's 2014 Mother's Day salary index -- would run you $62,985 a year, up from $59,862 in 2013. Breaking down the price of having someone else handle her various duties: Cooking and cleaning, $12,230 Child care, $21,736 Homework help, $7,290 Chauffeur, $5,672 Shopping, yard work, party and activity planning, finances, etc., $15,019 And my personal favorite, finding out what the kids are up to (paid in the equivalent value of a private detective), $1,036. Salary.com placed a higher value on moms in its 2014 Mother's Day salary survey, concluding that stay-at-home moms were worth $118,905 and working moms worth $70,107 (this does not include any paid salary from their job), with both groups putting more than 56 hours of overtime at home. These numbers are all up from last year's survey. Cooking It Up in a Pan Mom helps to pay for other things, too. Thanks to the Department of Agriculture, you can see what it costs to raise a child in the U.S. to 18. As of August 2013, the average cost is $241,080. This does not cover college, and hopefully dear old dad is contributing. In 2012, there were 10.3 million single U.S. mothers with children under 18, and one-third of women who gave birth in 2012 were single moms. By becoming moms, women give up time to do other things, what economists call an "opportunity cost." Particularly if your mother stayed at home when you were young, there are years or decades of lost wages, lost contributions to her Social Security, and missed chances at career advancement.Forbes used the example of a public school teacher, comparing her financial outcomes if stayed home or continued teaching. Becoming a stay-at-home mom would cost her an aggregate $700,000 in work benefits, and halve her Social Security benefit. The Census Bureau says 76 percent of moms are working moms, and that the number of stay-at-home mothers has slightly declined since 2008. Mothers, Priceless This year is the 100th anniversary of Mother's Day in America. A gesture by Anna Jarvis to remember her dear departed mother has escalated into an annual sales boon for businesses, small to large. Florists like FTD Companies (FTD) and 1-800-Flowers.com (FLWS) rank Mother's Day second only to Christmas, accounting for 25 percent of flowers and plants bought for holidays, surprisingly ahead of Valentine's Day. On average, Americans spent $168.94 on their moms last year and, according to the National Retail Federation annual Mother's Day Consumer Spending survey, are expected to spend $162.94 this year. Two thirds of us will buy flowers; 81 percent will give her a card; and a third will buy her apparel, with outings, books, housewares and jewelry among other popular gifts. Almost $20 billion will be spent. What Moms Really Want Of course, mom doesn't expect you to pay her back for all those years and dollars spent on you. Moms only want for us to be happy, healthy and appreciative: A mention in your Oscar speech like Jared Leto's beautiful tribute to his single mom, a moving quotation a la Abraham Lincoln ("All I am, or hope to be, I owe to my angel mother") or a dedication in your best-selling novel. If you can't pull those off, I suggest you go to Salary.com's mom salary wizard to print out a pretend check for Mom for the real-world equivalent of all she does for you. Slip it -- along with a gift card -- into the prettiest greeting card you can find, and let Mom know you truly understand what she's worth. It's the least you can do. More from Annalisa Kraft-Linder

BlueOrange Studio/Shutterstock One day out of 365, we pay homage to our sainted mothers. Those of us who are members of this long-suffering, uncomplaining, self-sacrificing class may get some soggy French toast in bed, (don't worry, kids; mom will clean up the kitchen), a chance to read in peace, or perhaps time to indulge in a long, hot bath. Bringing Home the Bacon If you really want to pay back mom for all she's done, get ready to pony up big. A card and some carnations (the official flower of Mother's Day, who knew?) just won't cut it. The cost of replacing mom as nurturer, nurse, cleaner and cook -- according to Insure.com's 2014 Mother's Day salary index -- would run you $62,985 a year, up from $59,862 in 2013. Breaking down the price of having someone else handle her various duties: Cooking and cleaning, $12,230 Child care, $21,736 Homework help, $7,290 Chauffeur, $5,672 Shopping, yard work, party and activity planning, finances, etc., $15,019 And my personal favorite, finding out what the kids are up to (paid in the equivalent value of a private detective), $1,036. Salary.com placed a higher value on moms in its 2014 Mother's Day salary survey, concluding that stay-at-home moms were worth $118,905 and working moms worth $70,107 (this does not include any paid salary from their job), with both groups putting more than 56 hours of overtime at home. These numbers are all up from last year's survey. Cooking It Up in a Pan Mom helps to pay for other things, too. Thanks to the Department of Agriculture, you can see what it costs to raise a child in the U.S. to 18. As of August 2013, the average cost is $241,080. This does not cover college, and hopefully dear old dad is contributing. In 2012, there were 10.3 million single U.S. mothers with children under 18, and one-third of women who gave birth in 2012 were single moms. By becoming moms, women give up time to do other things, what economists call an "opportunity cost." Particularly if your mother stayed at home when you were young, there are years or decades of lost wages, lost contributions to her Social Security, and missed chances at career advancement.Forbes used the example of a public school teacher, comparing her financial outcomes if stayed home or continued teaching. Becoming a stay-at-home mom would cost her an aggregate $700,000 in work benefits, and halve her Social Security benefit. The Census Bureau says 76 percent of moms are working moms, and that the number of stay-at-home mothers has slightly declined since 2008. Mothers, Priceless This year is the 100th anniversary of Mother's Day in America. A gesture by Anna Jarvis to remember her dear departed mother has escalated into an annual sales boon for businesses, small to large. Florists like FTD Companies (FTD) and 1-800-Flowers.com (FLWS) rank Mother's Day second only to Christmas, accounting for 25 percent of flowers and plants bought for holidays, surprisingly ahead of Valentine's Day. On average, Americans spent $168.94 on their moms last year and, according to the National Retail Federation annual Mother's Day Consumer Spending survey, are expected to spend $162.94 this year. Two thirds of us will buy flowers; 81 percent will give her a card; and a third will buy her apparel, with outings, books, housewares and jewelry among other popular gifts. Almost $20 billion will be spent. What Moms Really Want Of course, mom doesn't expect you to pay her back for all those years and dollars spent on you. Moms only want for us to be happy, healthy and appreciative: A mention in your Oscar speech like Jared Leto's beautiful tribute to his single mom, a moving quotation a la Abraham Lincoln ("All I am, or hope to be, I owe to my angel mother") or a dedication in your best-selling novel. If you can't pull those off, I suggest you go to Salary.com's mom salary wizard to print out a pretend check for Mom for the real-world equivalent of all she does for you. Slip it -- along with a gift card -- into the prettiest greeting card you can find, and let Mom know you truly understand what she's worth. It's the least you can do. More from Annalisa Kraft-Linder Cassandra Hubbart/AOL Some credit myths refuse to die. Let's go over three major myths that you should stop believing today. You Only Have One Credit Score Reality: This myth likely exists because we want it to be true. Credit scores would be so much easier to understand and cause less stress if we received the same scores from each lender. However, the reality is that you actually have many credit scores.

Cassandra Hubbart/AOL Some credit myths refuse to die. Let's go over three major myths that you should stop believing today. You Only Have One Credit Score Reality: This myth likely exists because we want it to be true. Credit scores would be so much easier to understand and cause less stress if we received the same scores from each lender. However, the reality is that you actually have many credit scores.