With shares of Nike (NYSE:NKE) trading around $66, is NKE an OUTPERFORM, WAIT AND SEE or STAY AWAY? Let�� analyze the stock with the relevant sections of our CHEAT SHEET investing framework:

T = Trends for a Stock’s Movement

Nike is engaged in the design, development, and worldwide marketing and selling of footwear, apparel, equipment, accessories and services. The company sells its products to retail accounts, through retail stores and Internet sales, and through a mix of independent distributors and licensees around the world. Nike focuses its product offerings in seven key categories: Running, Basketball, Soccer, Men�� Training, Women�� Training, Nike Sportswear, and Action Sports. It also markets products designed for kids, as well as for other athletic and recreational uses.

Recently, Nike delivered earnings and revenue figures that beat Wall Street�� expectations.�Looking around, many consumers and companies are advocating and opting for a lifestyle that involves more outdoor and physical activity.�As this movement continues, Nike is a company that is poised to see increased demand.

Top 5 Recreation Companies To Invest In 2015: Smith & Wesson Holding Corp (SWHC.O)

Smith & Wesson Holding Corporation (Smith & Wesson), incorporated on June 17, 1991, is a manufacturer of firearms. The Company manufactures a range of handguns, modern sporting rifles, hunting rifles, black powder firearms, handcuffs, and firearm-related products and accessories for sale to a range of customers, including gun enthusiasts, collectors, hunters, sportsmen, competitive shooters, individuals desiring home and personal protection, law enforcement and security agencies and officers, and military agencies in the United States and globally. It sell its products under the Smith & Wesson brand, the M&P brand, the Thompson/Center brand, and the Walther brand. The Company manufactures its firearm products at its facilities in Springfield, Massachusetts and Houlton, Maine. On July 26, 2012, it sold all of the assets of Smith & Wesson Security Solutions, Inc.

Firearms

During the fiscal year ended April 30, 2012 (fiscal 2012), the Company intr oduced multiple new handgun and modern sporting rifle models, and one new bolt action rifle platform. The Company's rifle introductions included the addition of the M&P15 300 Whisper to the Company's line of modern sporting rifles. As of April 30, 2012, the Company participated in three categories of the long-gun market and both core categories of the handgun market.

Handguns

The Company manufactures an variety of handgun models that include revolvers and pistols. A revolver is a handgun with a cylinder that holds the ammunition in a series of rotating chambers that are successively aligned with the barrel of the firearm during each firing cycle. There are two general types of revolvers: single-action and double-action. The Company's small-frame revolvers have been carried by law enforcement personnel and personal defense-minded citizens. The Company's revolvers are available in a variety of models and calibers, with applications in virtually all pr ofessional and personal markets.

The Company� �! s M&P15 Series of modern sporting rifles are designed to satisfy the functionality and reliability needs of global military, law enforcement, and security personnel. These rifles are also popular as sporting target rifles and are sold to consumers through the Company's sporting good distributors, retailers, and dealers. The Company has a range of product portfolio of modern sporting rifles, which includes a lower price-point, sport model, a .22 caliber model, and a fully automatic model designed for the exclusive use of military and law enforcement agencies throughout the world.

Hunting Firearms

The Company manufactures three lines of bolt-action rifles under its Thompson/Center brand consisting of several models in each line. The Company's hunting rifles are offered in 16 different calibers. Bolt-action rifles operate by the cycling of a bolt handle that allows for both the loading and unloading of rounds through a magazine fed system.

< p>During fiscal 2012, the Company introduced the Dimension bolt action rifle platform. Under the Company's Thompson/Center brand, the Company also offers seven models of American-made single shot black powder, or muzzle loader, firearms. The Company offers eight models of interchangeable, single shot firearm systems that deliver numerous gun, barrel, caliber configurations, and finishes. These systems can be configured as a center-fire rifle, rim-fire rifle, shotgun, black powder firearm, or single-shot handgun for use across the entire range of big- and small-game hunting.

Handcuffs

The Company manufactures handcuffs and restraints in the United States. The Company fabricates these products from the carbon or stainless steel.

Smith & Wesson Academy

Through the Smith & Wesson Academy, the Company offers instruction designed to meet the training needs of law enforcement and security customers worldwide. Classes are conduct ed at the Company's facility in Springfield, Massachus! etts o! r! on loca! tion around the world.

Specialty Services

The Company's services include forging, heat treating, finishing, and plating. It provides services to third-party customers.

The Company competes with Ruger,Taurus, Beretta, Glock, Heckler & Koch, Sig Sauer, Springfield Armory, Bushmaster, Rock River, Stag Arms, DPMS, Browning, Marlin, Remington, Ruger, Savage, Weatherby, CVA, Traditions, and Winchester.

Top 5 Recreation Companies To Invest In 2015: Accell Group NV (ACCG.AS)

Accell Group NV is a Netherlands-based holding company. The Company and its subsidiaries divides its business into two segments: Bicycle & Bicycle Parts, active in the design, development, production, marketing and sales of bicycles, bicycle parts and accessories; and Fitness, providing fitness equipment. It sells bicycles under the Batavus, Bremshey, Ghost, Haibike, Hercules, Koga, Lapierre, Loekie, Redline, Sparta, Staiger, Tunturi, Winora, XLC and Raleigh brands via specialist bicycle retailers as well as bicycle parts under the Juncker Bike Parts and Wiener Bike Parts brands and fitness equipment under the Bremshey Sport brand. The Company�� main markets are the Netherlands, Germany, France, and European countries. The Company has production facilities in the Netherlands, Germany, France, Hungary and Belgium. As of December 31, 2011, it operated through 21 wholly owned subsidiaries. On May 22, 2012, the Company acquired Raleigh Cycle Limited.

Smith & Wesson Holding Corporation (Smith & Wesson), incorporated on June 17, 1991, is a manufacturer of firearms. The Company manufactures a range of handguns, modern sporting rifles, hunting rifles, black powder firearms, handcuffs, and firearm-related products and accessories for sale to a range of customers, including gun enthusiasts, collectors, hunters, sportsmen, competitive shooters, individuals desiring home and personal protection, law enforcement and security agencies and officers, and military agencies in the United States and globally. It sell its products under the Smith & Wesson brand, the M&P brand, the Thompson/Center brand, and the Walther brand. The Company manufactures its firearm products at its facilities in Springfield, Massachusetts and Houlton, Maine. On July 26, 2012, it sold all of the assets of Smith & Wesson Security Solutions, Inc.

Firearms

During the fiscal year ended April 30, 2012 (fiscal 2012), the Company introduced multiple new handgun and modern sporting rifle models, and one new bolt action rifle platform. The Company's rifle introductions included the addition of the M&P15 300 Whisper to the Company's line of modern sporting rifles. As of April 30, 2012, the Company participated in three categories of the long-gun market and both core categories of the handgun market.

Handguns

The Company manufactures an variety of handgun models that include revolvers and pistols. A revolver is a handgun with a cylinder that holds the ammunition in a series of rotating chambers that are successively aligned with the barrel of the firearm during each firing cycle. There are two general types of revolvers: single-action and double-action. The Company's small-frame revolvers have been carried by law enforcement personnel and personal defense-minded citizens. The Company's revolvers are available in a variety of models and calibers, with applications in virtually all professional and personal markets.

The Company�� M! &P15 Series of modern sporting rifles are designed to satisfy the functionality and reliability needs of global military, law enforcement, and security personnel. These rifles are also popular as sporting target rifles and are sold to consumers through the Company's sporting good distributors, retailers, and dealers. The Company has a range of product portfolio of modern sporting rifles, which includes a lower price-point, sport model, a .22 caliber model, and a fully automatic model designed for the exclusive use of military and law enforcement agencies throughout the world.

Hunting Firearms

The Company manufactures three lines of bolt-action rifles under its Thompson/Center brand consisting of several models in each line. The Company's hunting rifles are offered in 16 different calibers. Bolt-action rifles operate by the cycling of a bolt handle that allows for both the loading and unloading of rounds through a magazine fed system.

During fiscal 2012, the Company introduced the Dimension bolt action rifle platform. Under the Company's Thompson/Center brand, the Company also offers seven models of American-made single shot black powder, or muzzle loader, firearms. The Company offers eight models of interchangeable, single shot firearm systems that deliver numerous gun, barrel, caliber configurations, and finishes. These systems can be configured as a center-fire rifle, rim-fire rifle, shotgun, black powder firearm, or single-shot handgun for use across the entire range of big- and small-game hunting.

Handcuffs

The Company manufactures handcuffs and restraints in the United States. The Company fabricates these products from the carbon or stainless steel.

Smith & Wesson Academy

Through the Smith & Wesson Academy, the Company offers instruction designed to meet the training needs of law enforcement and security customers worldwide. Classes are conducted at the Company's facility in Springfield, Massachusetts or o! n locatio! n around the world.

Specialty Services

The Company's services include forging, heat treating, finishing, and plating. It provides services to third-party customers.

The Company competes with Ruger,Taurus, Beretta, Glock, Heckler & Koch, Sig Sauer, Springfield Armory, Bushmaster, Rock River, Stag Arms, DPMS, Browning, Marlin, Remington, Ruger, Savage, Weatherby, CVA, Traditions, and Winchester.

Advisors' Opinion: - [By Hibah Yousuf]

What's moving: Smith & Wesson (SWHC) shares tumbled after the gun maker reported a disappointing outlook for the current quarter.

Facebook (FB) shares rose 3%. The social network's stock hit a new 52-week high of $44.61 and is inching closer to its all-time high of $45. The rise made Facebook the most talked about stock among StockTwits traders. But investors were divided on whether Facebook's gains are warranted.

Top 5 Recreation Companies To Invest In 2015: In Ovations Holdings Inc (INOH)

In Ovations Holdings Inc, formerly Marine Exploration, Inc., incorporated on June 27, 1996, is engaged in marine treasure hunting expeditions. Its operations are limited to providing funding to, and making approved capital expenditures for its joint venture partner, Hispaniola Ventures, LLC (Hispaniola). Hispaniola is engaged in the actual search for, diving to, and recovery of, the cargo and artifacts. In May 2012, the Company acquired Atmospheric Water Solutions, Inc. (AWS). The acquisition includes water making technology, inventory, and a distribution center. In January 2014, the Company announced the incorporation of of its Energy Services Company (ESCO), Electro Verde, Inc.

The Company is focused on the recovery of two vessels, named as Operation Mystery Galleon and Operation Abrojos which includes, without limitation, an operation to the Serranilla and Bajo Nuevo Banks in the Caribbean Sea. It is undergoing preliminary operations off the coast of the Dominican Republic. On December 11, 2008, Marine Exploration Inc's 128 ft operations vessel, the M/V Hispaniola, was launched for its primary missions, Operation Mystery Galleon and Operation Abrojos.

The Company competes with Odyssey Marine Exploration, Subsea Resources Ltd., Sovereign Exploration Associates International Inc. and Admiralty Holding Company.

Top 5 Recreation Companies To Invest In 2015: Accell Group NV (ACCEL)

Accell Group NV is a Netherlands-based holding company. The Company and its subsidiaries divides its business into two segments: Bicycle & Bicycle Parts, active in the design, development, production, marketing and sales of bicycles, bicycle parts and accessories; and Fitness, providing fitness equipment. It sells bicycles under the Batavus, Bremshey, Ghost, Haibike, Hercules, Koga, Lapierre, Loekie, Redline, Sparta, Staiger, Tunturi, Winora, XLC and Raleigh brands via specialist bicycle retailers as well as bicycle parts under the Juncker Bike Parts and Wiener Bike Parts brands and fitness equipment under the Bremshey Sport brand. The Company�� main markets are the Netherlands, Germany, France, and European countries. The Company has production facilities in the Netherlands, Germany, France, Hungary and Belgium. As of December 31, 2011, it operated through 21 wholly owned subsidiaries. On May 22, 2012, the Company acquired Raleigh Cycle Limited.

[ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] Not likely: Although the sign says "Bipartisan Deal," most IN readers doubt Congress members, including Democratic leader Harry Reid, can reach a long-term budget deal. Bloomberg News

Not likely: Although the sign says "Bipartisan Deal," most IN readers doubt Congress members, including Democratic leader Harry Reid, can reach a long-term budget deal. Bloomberg News  In its long history, International Business Machines Corp. (NYSE: IBM) has been a pioneer in several technology areas. But the company surprisingly also has led the way when it comes to financial engineering. IBM has been actively and consistently buying its own stock for 20 years, foreshadowing a trend that became popular in the 21st century.

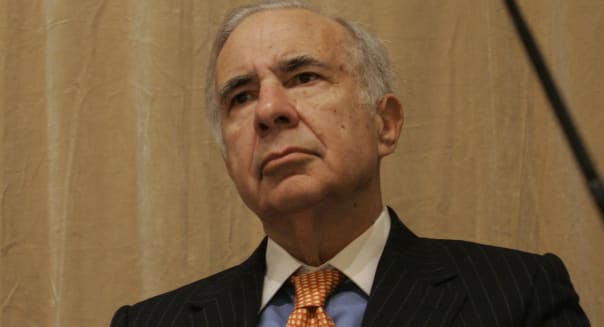

In its long history, International Business Machines Corp. (NYSE: IBM) has been a pioneer in several technology areas. But the company surprisingly also has led the way when it comes to financial engineering. IBM has been actively and consistently buying its own stock for 20 years, foreshadowing a trend that became popular in the 21st century. AP/Shiho FukadaActivist investor Carl Icahn loves to give advice to public companies. But this week, his advice for eBay felt a couple of years behind the curve. Companies can make brilliant moves, but there are also times when things don't work out quite as planned. From a classy handbag maker carrying its latest financials to market, to a blowout report by the leading streaming video service, here's a rundown of the week's best and worst in the business world. Netflix (NFLX) -- Winner Netflix was last year's top performer among S&P 500 stocks, and it's off to another strong start in 2014. Shares of the leading video service hit another all-time high this week after it posted blowout quarterly results. Netflix closed out the year on a strong note with more than 44 million streaming subscribers worldwide and expanding profit margins. It expects to top 48 million streaming members by the end of March. Strong financial results naturally make you a winner, but Netflix also got the market excited by announcing that it will soon offer a variety of pricing plans. More importantly, it's suggesting that it may eventually increase the price of its basic $7.99 a month plan. Coach (COH) -- Loser Luxury handbags are still selling, but Coach totes aren't faring as well. The iconic maker of high-end purses and accessories posted disappointing quarterly results on Tuesday. Sales declined by 6 percent during the seasonally potent holiday quarter, and net income took an even bigger hit. Foreign currency translations weighed on the results, but sales still would have been lower if there weren't any currency fluctuations. Coach investors shouldn't be surprised. Sales, net income, and store-level comparable sales also slipped three months earlier. It's not the niche. Michael Kors (KORS) has been able to post healthy double-digit growth through the gradual fade in prominence at Coach. Beats Music -- Winner Music streaming has become popular, and that's big for the music industry. CD sales peaked more than a decade ago, and last year was the first year that we saw MP3 sales decline. Royalties from streaming music is a big driver for the industry these days, and on Tuesday we saw the debut of Beats Music. Beats Music is notable because of its celebrity execs. Dr. Dre, Nine Inch Nails' Trent Reznor, and iconic music producer Jimmy Iovine are some of the big names behind this platform, which aims to raise the bar by providing curated playlists based on highly customized preferences. It's not a free service, though naturally it's kicking things off with free trials. Beats Music is also teaming up with AT&T (T) to offer a discounted family plan for AT&T Wireless customers. That's one way to stand out in a crowd. Carl Icahn -- Loser Billionaire activist investor Carl Icahn took aim at eBay (EBAY) earlier this week, arguing that the online marketplace giant would be better off it if spun off PayPal. It's true that PayPal is the star at eBay. It has been for years. However, this suggestion would've made more sense a couple of years ago when eBay.com was struggling. Shortly after Icahn's suggestion, eBay reported healthy double-digit growth at both PayPal and its marketplace division. Yes, PayPal's 19 percent pop in revenue is better than the marketplace's 12 percent advance. However, Icahn is going to have a hard time convincing the market that eBay should divest itself of PayPal at a time when its two primary businesses are holding up just fine. On the bright side, Icahn also disclosed that he increased his stake in Apple (AAPL) by $500 million. That's not a bad idea at a time when Apple is getting ready to report quarterly results next week. Analysts see this as the first quarter in nearly a year that Apple grows its revenue and earnings per share. Chili's -- Winner Casual dining has had a rough holiday quarter. Between December's wintry blasts and the growing popularity of fast casual chains, traditional table service restaurants have been struggling lately. Brinker International's (EAT) bucked the trend by posting sales growth, positive comps, and expanding profit margins. These are three things that investors didn't see at Red Lobster or Ruby Tuesday (RT) in recent weeks. As a welcome bonus, Brinker's smaller Italian concept -- Maggiano's Little Italy -- posted another period of positive comps. The family-style restaurant has come through with 16 consecutive quarters of positive comparable restaurant sales growth. At least some of the casual dining chains are still cooking.

AP/Shiho FukadaActivist investor Carl Icahn loves to give advice to public companies. But this week, his advice for eBay felt a couple of years behind the curve. Companies can make brilliant moves, but there are also times when things don't work out quite as planned. From a classy handbag maker carrying its latest financials to market, to a blowout report by the leading streaming video service, here's a rundown of the week's best and worst in the business world. Netflix (NFLX) -- Winner Netflix was last year's top performer among S&P 500 stocks, and it's off to another strong start in 2014. Shares of the leading video service hit another all-time high this week after it posted blowout quarterly results. Netflix closed out the year on a strong note with more than 44 million streaming subscribers worldwide and expanding profit margins. It expects to top 48 million streaming members by the end of March. Strong financial results naturally make you a winner, but Netflix also got the market excited by announcing that it will soon offer a variety of pricing plans. More importantly, it's suggesting that it may eventually increase the price of its basic $7.99 a month plan. Coach (COH) -- Loser Luxury handbags are still selling, but Coach totes aren't faring as well. The iconic maker of high-end purses and accessories posted disappointing quarterly results on Tuesday. Sales declined by 6 percent during the seasonally potent holiday quarter, and net income took an even bigger hit. Foreign currency translations weighed on the results, but sales still would have been lower if there weren't any currency fluctuations. Coach investors shouldn't be surprised. Sales, net income, and store-level comparable sales also slipped three months earlier. It's not the niche. Michael Kors (KORS) has been able to post healthy double-digit growth through the gradual fade in prominence at Coach. Beats Music -- Winner Music streaming has become popular, and that's big for the music industry. CD sales peaked more than a decade ago, and last year was the first year that we saw MP3 sales decline. Royalties from streaming music is a big driver for the industry these days, and on Tuesday we saw the debut of Beats Music. Beats Music is notable because of its celebrity execs. Dr. Dre, Nine Inch Nails' Trent Reznor, and iconic music producer Jimmy Iovine are some of the big names behind this platform, which aims to raise the bar by providing curated playlists based on highly customized preferences. It's not a free service, though naturally it's kicking things off with free trials. Beats Music is also teaming up with AT&T (T) to offer a discounted family plan for AT&T Wireless customers. That's one way to stand out in a crowd. Carl Icahn -- Loser Billionaire activist investor Carl Icahn took aim at eBay (EBAY) earlier this week, arguing that the online marketplace giant would be better off it if spun off PayPal. It's true that PayPal is the star at eBay. It has been for years. However, this suggestion would've made more sense a couple of years ago when eBay.com was struggling. Shortly after Icahn's suggestion, eBay reported healthy double-digit growth at both PayPal and its marketplace division. Yes, PayPal's 19 percent pop in revenue is better than the marketplace's 12 percent advance. However, Icahn is going to have a hard time convincing the market that eBay should divest itself of PayPal at a time when its two primary businesses are holding up just fine. On the bright side, Icahn also disclosed that he increased his stake in Apple (AAPL) by $500 million. That's not a bad idea at a time when Apple is getting ready to report quarterly results next week. Analysts see this as the first quarter in nearly a year that Apple grows its revenue and earnings per share. Chili's -- Winner Casual dining has had a rough holiday quarter. Between December's wintry blasts and the growing popularity of fast casual chains, traditional table service restaurants have been struggling lately. Brinker International's (EAT) bucked the trend by posting sales growth, positive comps, and expanding profit margins. These are three things that investors didn't see at Red Lobster or Ruby Tuesday (RT) in recent weeks. As a welcome bonus, Brinker's smaller Italian concept -- Maggiano's Little Italy -- posted another period of positive comps. The family-style restaurant has come through with 16 consecutive quarters of positive comparable restaurant sales growth. At least some of the casual dining chains are still cooking.