General Electric's (NYSE: GE ) aviation unit -- GE Aviation -- has been 'powering a century of flight' across the globe. During the First World War, the company designed America's first airplane engine "booster" or turbosupercharger, and in the 90-odd years that have passed, it's crossed several important milestones. GE built America's first jet engine and has emerged as one of the world's leading producers of commercial aircraft engines. The company plans to invest $3.5 billion in the aviation unit by 2017. Let's find out what's making the company do so, and whether it will take GE to new highs.

Focus on GE Aviation

It's not difficult to understand why GE is investing so heavily in aviation as the segment generates the lion's share of the company's industrial sales and profits. In the recently concluded second quarter, the segment was the second-highest revenue earner among all industrial businesses. It made up for 22.6% ($6.1 billion) of GE's industrial revenues, losing only to the Power business, which accounted for 23.4% ($6.3 billion). In terms of industrial segment profits, GE Aviation took the ace position, contributing 28.7%, ahead of the Power segment's 27.2%. But this may not be the only reason why GE is pumping $3.5 billion into aviation -- it has also to do with the segment's huge upside potential.

GE Aviation, Source: Flickr

Fuel-efficient engines are in high demand

The U.S. aircraft major Boeing has forecast that between 2013 and 2032, global passenger traffic will increase 5% annually, spurring demand for 35,280 new aircraft. One crucial element that helps traffic grow is attractive fares. But, keeping fares in check isn't easy for airlines as the soaring fuel costs make up one-third of their total operating expense bill. This has turned the tide toward fuel-efficient planes.

Oil-guzzling Boeing 747 or Airbus A380 are fast falling out of favor, prompting aero-majors to come up with new planes and reengineered versions of old planes that score high on fuel efficiency and cost savings.

There's a fuel-save promise attached to the entire new breed, whether it is Boeing's built-from-scratch 787 Dreamliner that boasts "10% lesser cash seat mile costs than peer planes," or reengineered 777X that touts "12% lower fuel consumption and 10% lower operating costs than the competition." The 737 Max aims to "reduce fuel use and CO2 emissions by an additional 14% over today's most fuel-efficient single-aisle airplanes." Airbus' all-new A350 XWB claims to be 25% more fuel-efficient than existing planes, and the reengineered A320neo and A330neo assert 14%-15% savings.

Aircraft makers can live up to their lofty claims with the help of advanced engineering and better engines. And this is where GE Aviation's opportunities lie. The company has an added advantage as its engines are used by all three major commercial aircraft segments -- regional, narrow body, and wide body. Rival Pratt & Whitney serves only regional and narrow-body airplanes, while Rolls Royce caters primarily to the wide-body segment.

GE Testing Next-Gen Jet Engine with 3D Printed Parts, Source: Flickr

A big LEAP

GE has been quick to spot the prospects and is busy building next generation engines for next generation aircraft. Its GEnx engines have already won plenty of accolades and have become the company's fastest-selling engine family, with an order backlog crossing the 1,300 mark. It offers 15% better fuel efficiency compared to the older CF6 engine, and at the same time reduces carbon-dioxide emissions. The GEnx engines power Boeing's 787 Dreamliners.

But GE's latest engineering marvel is the LEAP engine that goes a mile further in delivering performance. The engines will be manufactured in collaboration with Snecma (Safran) of France. GE is using 3D printing (also known as additive manufacturing) to make 19 fuel nozzles for the engine, which could lower fuel costs by 15% and help save up to $1 million annually, per airplane. The LEAP engines will power Boeing 737 Max, Airbus A320neo, and COMAC C919.

The $3.5 billion investment will go into upgrading facilities and equipment around the globe, with a major thrust on the U.S. The plan includes building a LEAP engine manufacturing plant in West Lafayette, Indiana for $100 million. GE will also make LEAP engines at its existing factory in Durham, North Carolina. David Joyce, GE Aviation president and CEO, has said, "Beginning in 2015, the LEAP engine will experience a dramatic production ramp-up for the remainder of the decade." The company wants to ramp up total engine production by 30% to 3,300 engines by 2020 from 2,600 engines in 2013.

Last thoughts

GE is grabbing the opportunity thrown by the booming commercial aircraft market with both hands. The company knows it has a critical role to play in aircraft makers' and airlines' pursuit of fuel-efficient next-generation planes. By establishing new standards of efficiency and fuel savings in engine technology, GE has set its sight on the future of aviation, and newer highs for itself.

You can't afford to miss this

"Made in China" -- an all too familiar phrase. But not for much longer: There's a radical new technology out there, one that's already being employed by the U.S. Air Force, BMW and even Nike. Respected publications like The Economist have compared this disruptive invention to the steam engine and the printing press; Business Insider calls it "the next trillion dollar industry." Watch The Motley Fool's shocking video presentation to learn about the next great wave of technological innovation, one that will bring an end to "Made In China" for good. Click here!

Steve Remich

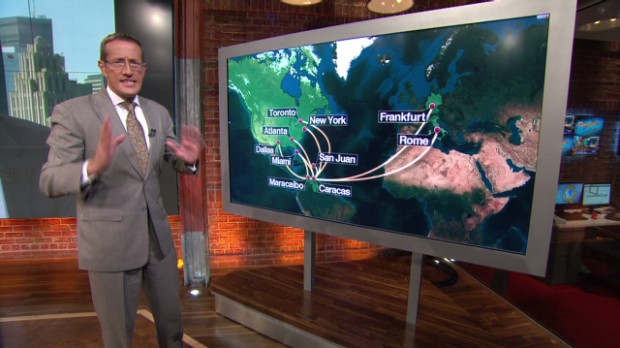

Steve Remich  U.S. flights to Israel grounded NEW YORK (CNNMoney) It seems like nothing can stop the aviation industry from its jet fueled joy ride.

U.S. flights to Israel grounded NEW YORK (CNNMoney) It seems like nothing can stop the aviation industry from its jet fueled joy ride.  Airlines in currency war with Venezuela

Airlines in currency war with Venezuela  Getty ImagesSometimes you can support the local economy while back-to-school shopping. Back-to-school shopping season is in full swing with big box retailers offering door buster discounts that rival even Black Friday deals. While cheap notebooks and markers aren't nearly as thrilling as bargain flat screens and tablets, the throngs of parents and students crowding the stores suggest otherwise, as do the numbers. According to data from the National Retail Federation, the average family with children in kindergarten through high school will spend $669.28 on back-to-school shopping this year, up roughly 5 percent from last year. Confronted with those increased spending expectations, it's no wonder the crowds are flocking to discount retailers like Walmart (WMT) and Target (TGT) in the hopes of reducing their costs. But while big box stores and online giants like Amazon.com (AMZN) might carry all the necessary supplies at the most competitive prices, they don't always offer the smartest value buys in the long term. Here are some factors and alternatives to consider before rushing to the Walmart "action aisle" to stock up. Consider the local cost. According to a 2011 study, every $100 spent at locally-owned businesses contributes an additional $58 to the local economy. By comparison, $100 spent at a chain store yields just $33 in local economic impact. In other words, shopping at local businesses ensures that more of what you spend will be reinvested back into your community, which means a better local economy, better roads, more support for police, fire and rescue departments and better schools. In recent years, school districts have been facing financial hardship as cuts are increasing and budgets are getting tighter. Because the schools themselves have less money for communal supplies like tissues, copy paper and printer ink, the financial burden gets passed down to parents and students in the form of longer and more expensive back-to-school supply lists. Shopping for those supplies locally rather than online or at the discount giants can infuse more money into the local economy, including the schools. In the long run, that should help lessen the financial burden on parents and students facing back-to-school costs. Go green. With reams of paper and notebooks for every subject made mandatory on just about every back to school supply list, it's easy to forget about being "green." But keeping the environmental impact in mind might actually prove helpful on the savings front. Before hitting the stores, take inventory of what you already have. Any unused or partially used notebooks from last year? Perhaps some binders and folders can be repurposed. Give old pencils a sharpening and bring back dried-out markers with some rubbing alcohol. The more you can reuse and recycle, the better for the environment and your wallet. This "green" principle can also be applied to back-to-school staples beyond the basics, like clothing, backpacks and electronics. Rather than buying new, connect with friends, neighbors and others in the local community to barter, swap and save. Sites such as Craigslist and Freecycle offer good starting points for scoring reusable supplies at a discount. For more specialized items like graphing calculators, try approaching last years' graduates or see what's available on eBay. Either strategy is a simple way to ensure reuse in addition to significant savings. Teach the lesson. In the rush to get everything prepped for the first day, there's a tendency to exclude the students themselves from the back-to-school purchasing process. While it might be easier to push through the crowds solo, parents miss a huge opportunity to teach important monetary lessons by leaving the kids at home. Back-to-school season is an ideal time to provide children with a hands-on financial education. Get them involved in setting and sticking to a budget for their supplies. Obviously a kindergartner will be a lot more passive in the process than a high school student, but instilling the lessons of comparison shopping, couponing, choosing brand name or generic, assessing price versus value and differentiating needs from wants early on and with more responsibility and involvement each year can prove incredibly valuable in preparing a child for his or her financial future. As you tackle your back-to-school shopping this year, consider what's beyond the bottom line before hitting the stores. With these things in mind, you might find yourself and your kids shopping smarter. .

Getty ImagesSometimes you can support the local economy while back-to-school shopping. Back-to-school shopping season is in full swing with big box retailers offering door buster discounts that rival even Black Friday deals. While cheap notebooks and markers aren't nearly as thrilling as bargain flat screens and tablets, the throngs of parents and students crowding the stores suggest otherwise, as do the numbers. According to data from the National Retail Federation, the average family with children in kindergarten through high school will spend $669.28 on back-to-school shopping this year, up roughly 5 percent from last year. Confronted with those increased spending expectations, it's no wonder the crowds are flocking to discount retailers like Walmart (WMT) and Target (TGT) in the hopes of reducing their costs. But while big box stores and online giants like Amazon.com (AMZN) might carry all the necessary supplies at the most competitive prices, they don't always offer the smartest value buys in the long term. Here are some factors and alternatives to consider before rushing to the Walmart "action aisle" to stock up. Consider the local cost. According to a 2011 study, every $100 spent at locally-owned businesses contributes an additional $58 to the local economy. By comparison, $100 spent at a chain store yields just $33 in local economic impact. In other words, shopping at local businesses ensures that more of what you spend will be reinvested back into your community, which means a better local economy, better roads, more support for police, fire and rescue departments and better schools. In recent years, school districts have been facing financial hardship as cuts are increasing and budgets are getting tighter. Because the schools themselves have less money for communal supplies like tissues, copy paper and printer ink, the financial burden gets passed down to parents and students in the form of longer and more expensive back-to-school supply lists. Shopping for those supplies locally rather than online or at the discount giants can infuse more money into the local economy, including the schools. In the long run, that should help lessen the financial burden on parents and students facing back-to-school costs. Go green. With reams of paper and notebooks for every subject made mandatory on just about every back to school supply list, it's easy to forget about being "green." But keeping the environmental impact in mind might actually prove helpful on the savings front. Before hitting the stores, take inventory of what you already have. Any unused or partially used notebooks from last year? Perhaps some binders and folders can be repurposed. Give old pencils a sharpening and bring back dried-out markers with some rubbing alcohol. The more you can reuse and recycle, the better for the environment and your wallet. This "green" principle can also be applied to back-to-school staples beyond the basics, like clothing, backpacks and electronics. Rather than buying new, connect with friends, neighbors and others in the local community to barter, swap and save. Sites such as Craigslist and Freecycle offer good starting points for scoring reusable supplies at a discount. For more specialized items like graphing calculators, try approaching last years' graduates or see what's available on eBay. Either strategy is a simple way to ensure reuse in addition to significant savings. Teach the lesson. In the rush to get everything prepped for the first day, there's a tendency to exclude the students themselves from the back-to-school purchasing process. While it might be easier to push through the crowds solo, parents miss a huge opportunity to teach important monetary lessons by leaving the kids at home. Back-to-school season is an ideal time to provide children with a hands-on financial education. Get them involved in setting and sticking to a budget for their supplies. Obviously a kindergartner will be a lot more passive in the process than a high school student, but instilling the lessons of comparison shopping, couponing, choosing brand name or generic, assessing price versus value and differentiating needs from wants early on and with more responsibility and involvement each year can prove incredibly valuable in preparing a child for his or her financial future. As you tackle your back-to-school shopping this year, consider what's beyond the bottom line before hitting the stores. With these things in mind, you might find yourself and your kids shopping smarter. .

Related BZSUM U.S. Stocks Reverse; Cheetah Mobile Back In Google App Store Rankings Markets Open Higher; Brinker Profit Misses Estimates

Related BZSUM U.S. Stocks Reverse; Cheetah Mobile Back In Google App Store Rankings Markets Open Higher; Brinker Profit Misses Estimates

Popular Posts: 10 Best “Strong Buy” Stocks — TRGP YY ILMN and more11 Biotechnology Stocks to Buy Now10 Oil and Gas Stocks to Buy Now Recent Posts: Hottest Financial Stocks Now – NSM HNT FBP ASPS Biggest Movers in Healthcare Stocks Now – IRWD IPXL SGEN PCRX Hottest Technology Stocks Now – PEGA AOL ATVI BITA View All Posts 10 Insurance Stocks to Sell Now

Popular Posts: 10 Best “Strong Buy” Stocks — TRGP YY ILMN and more11 Biotechnology Stocks to Buy Now10 Oil and Gas Stocks to Buy Now Recent Posts: Hottest Financial Stocks Now – NSM HNT FBP ASPS Biggest Movers in Healthcare Stocks Now – IRWD IPXL SGEN PCRX Hottest Technology Stocks Now – PEGA AOL ATVI BITA View All Posts 10 Insurance Stocks to Sell Now