In what will without question be a crushing blow to the solar industry, the European Union is ready to punish Chinese solar imports with a huge tariff imposed on them of an average of 47 percent, for the majority of photovoltaic panels. Most people are scratching their heads over this, as it'll harm the largest solar farms in the EU, and only benefit a small group of solar manufacturers. Many feel if the June 6 deadline is adhered to, it will crush the solar industry, and not only in China.

This is the result of the Chinese dominating a market once controlled by European companies. Fast growth by Chinese manufacturers has resulted in a glut, which has shrunk margins, pushing a number of companies into bankruptcy.

What is strange is if the EU was going to take action, it should have been long ago, not when the damage has already been done. It's more a representation of being sore losers than attempting to level the playing field, as European representatives assert.

The point is there is simply no benefit from Europe doing this economically. I think the reason Europe is doing it is because of the hype surrounding solar reported in the media, which when China has ended up the winner, has made Europe, as well as the U.S., lose face globally.

It exposes the silliness that somehow renewable energy is the economic savior the world has been looking for. This is in light of huge new discoveries of natural gas and oil. The narrative has been torn down and there is little left but petty political moves to cover it up.

Consequences

Nonetheless, if the decision to go ahead with this is made, it will have an adverse effect on Chinese manufacturers, who have themselves been struggling to be profitable in a weak global economy. Estimates are that over 100 China-based solar manufacturers will be affected by the actions.

Hit the hardest will probably be Yingli Green Energy (YGE) and Trina Solar (TSL), two of the larger solar manufacturers in China.

Trina! Solar

(Click to enlarge)

Yingli Green Energy

(Click to enlarge)

Other companies of note that will be hurt will be LDK Solar (LDK), Suntech Power (STP), JA Solar Holdings Co., Ltd. (JASO) and Renesola (SOL) among others. Some these are already hanging on by a thread because of taking on too much debt and defaulting on bonds.

Solar Farms

The large solar farms in the EU will be those suffering the biggest impact of the trade war, as they usually buy the lower-priced panels and modules from China, as it is a huge part of the costs of doing business. That means the alleged commitment by the EU to renewable energy has to be questioned, as many of these farms will no longer survive if prices soar in response to tariffs.

On the other hand, smaller solar farms based in the EU won't suffer much from the situation, as they usually buy panels form Japan, Korea, and Germany. Again, from a policy perspective, none of this makes any sense. It appears Europe is willing to trash solar in order to keep the Chinese from offering quality solar products at a good price.

Investment Implications

The immediate thing to watch for if Europe does go through with this is for a number of Chinese companies to be acquired. That presents a good opportunity for those who can narrow down which publicly traded companies will struggle the most for higher prices.

LDK Solar and Suntech Power immediately come to mind, although their debt problems could make them undesirable to more healthy competitors. I would look for solar companies with not too much of a debt load but are still surviving while attempting to carve out a niche.

Companies with a lot of exposure to European markets could get hamm! ered, and! that presents an opportunity to short them. If you're in them, you better sell them, or tighten up your stop-loss position.

Another possibility that must be taken into consideration is if there is an ETF with significant holdings in Chinese solar companies. If so, they will also get hit hard going forward.

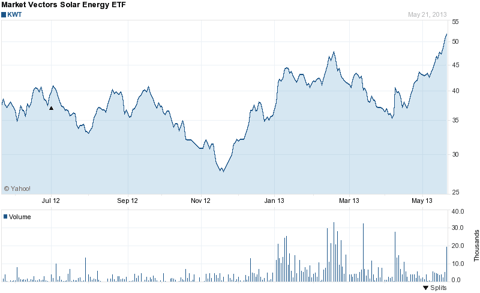

Neither Guggenheim Solar ETF (TAN) or Market Vectors Solar Energy ETF (KWT), which have been performing well of late, have major exposure to Chinese solar companies. Each one holds Trina solar, with Guggenheim Solar having it represent 4.14 percent of its assets as of March 28, and Market Vectors Solar Energy ETF having it as 4.27 percent of its assets held as of February 27.

Guggenheim Solar ETF

(Click to enlarge)

Market Vectors Solar Energy ETF

(Click to enlarge)

What About Recent Surge in Solar Company Shares?

An interesting anomaly occurred when Yingli Green Energy reported its shipments in the first quarter declined by less than expected, pushing the share price up by $0.45, a gain of over 14 percent. It pulled much of the solar industry up with it. Also contributing to the unexpected strength was a report by Lux Research projecting the current supply glut will be over by 2015.

What's interesting about that in light of the EU tariffs, is the industry is cleansing itself out, as markets tend to do when left alone, and it shows it would have balanced out within a couple of years, assuming the data and assertions are correct. This is even a better reason to short these Chinese solar companies, as they're going to fall back quickly once it appears the EU has no attention of backing down.

Risk

What is the risk in all of this? The risk is if Europ! e decides! to change its mind and pulls back on the tariffs. That's unlikely because of the somewhat brash and aggressive way it positioned itself in the media. One possibility is it may lower the tariff to less drastic levels.

Either way, it looks like Europe is foolishly weakening the solar industry at a time when it is already floundering. Unexpected consequences are already being identified, with a lot of that being in Europe itself, as mentioned earlier with the probability of large solar farms failing.

Conclusion

Solar is going to become even more volatile, and that's good for those shorting or moving in and out of solar companies quickly. For those with a longer investment outlook, solar is definitely not the place to have any of your capital.

American-based companies like SunPower (SPWR) and First Solar (FSLR) shouldn't be affected by the decisions of Europe, unless it's in response to the industry in general looking chaotic and weak from the media reports flowing out of the damage to solar companies in China. That's because thin-film solar panels won't be affected by duties to be imposed in the EU.

For anyone holding a Chinese company with a lot of European exposure, it's time to cut and run. I wouldn't wait to see if Europe changes its mind. A lot of money could be made by shorting these companies, and that looks like the best play here.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment