BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>5 Stocks Set to Soar on Bullish Earnings

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>Why Apple's Lower Price Tag Spells Bigger Gains in 2014

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

Ulta Salon, Cosmetics & Fragrance

Nearest Resistance: $105

Nearest Support: $85

Catalyst: Q1 Earnings

Beauty retailer Ulta Salon, Cosmetics & Fragrance (ULTA) is sitting pretty this afternoon, up more than 14.6% following the firm's positive first-quarter earnings numbers hit Wall Street. Ulta earned 77 cents per share last quarter, besting analysts' 74-cent best guess. More important, the firm provided a rosy forecast for the second quarter, estimating earnings would fall between 78 cents and 83 cents per share. Investors were hoping for an 82-cent profit next quarter.

ULTA's chart has been looking pretty unattractive for the past several months, but that's changing thanks to a double-bottom setup that started forming in shares at the start of 2014. From here, the level to watch is $105. If buyers can bid shares up above that price ceiling, we've got a buyable breakout in this beauty products retailer.

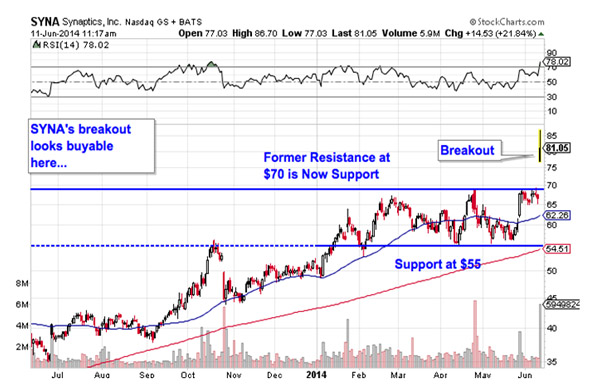

Synaptics

Nearest Resistance: N/A

Nearest Support: $70

Catalyst: Outlook Boost, Renesas Acquisition

Tech name Synaptics (SYNA) is up more than 24% this afternoon, buoyed by a hike in earnings guidance as well as by news that SYNA is acquiring Japanese display driver firm Renesas SP Drivers for $475 million. The firm expects the acquisition to help drive sales to between $300 million and $310 million next quarter, a material sales boost. Today's big gap up is sending SYNA to new all-time highs this afternoon.

New highs are significant from an investor psychology standpoint because they mean that everyone who has bought shares in the last year is sitting on gains. As a result, the "back to even" mentality is less of a concern than it would be for a name with a higher proportion of shareholders sitting on losses. Today's breakout is buyable here, but it makes sense to keep a tight protective stop in place.

Delta Air Lines

Nearest Resistance: $42

Nearest Support: $36

Catalyst: Industry Correction

Delta Airlines (DAL) owns the undesirable distinction of being the biggest single-day loser in the S&P 500 as of this writing today. The better news is that Delta's pullback is just 3% and change. Delta is correcting as part of a larger move lower in the airline industry today, meaning that it's far from alone in giving back a few points. But that doesn't change the fact that DAL has been one of the best-performing large-cap names in 2014, and this is still very much a "buy the dips stock."

Delta continues to bounce its way higher in a textbook uptrending channel. In the context of that well-defined technical setup, today's correction isn't just immaterial -- it's expected. Look for another buying opportunity when DAL gets back down towards trendline support for a fifth time in the last year.

Achillion Pharmaceuticals

Nearest Resistance: $7.60

Nearest Support: $4.20

Catalyst: Technical Setup

Biopharma firm Achillion Pharmaceuticals (ACHN) is correcting 6.5% on big volume this afternoon, the latest high-profile day for the $706 million drug company since the acquisition of peer name Idenix Pharmaceuticals (IDIX) triggered speculation about a similar buyout deal for ACHN. Since Monday, shares are up more than 153%, which, in context, makes this afternoon's correction look a whole lot less painful.

I'd avoid buying into ACHN until it can establish some semblance of support. With the next-nearest glut of buying pressure all the way down at $4.20, there's a lot of potential loss if some unforeseen event pulls the rug out from Achillion's newfound lofty valuation.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>5 Health Care Stocks to Trade for Gains

>>5 Rocket Stocks to Buy for June Gains

>>3 Stocks Under $10 Making Big Moves

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in the names mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment