Believe that a China slowdown is imminent? One way of taking advantage of your idea is to short Rio Tinto (RIO).

Operating and Net Margins

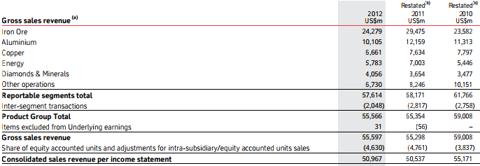

A huge portion of Rio Tinto sales revenue come from hard metal like iron ore, aluminum and copper. This makes Rio Tinto particularly susceptible to a China slowdown, as a slowdown may adversely affect such metal prices. Declining metal prices can result in large operating losses.

(click to enlarge)

Sources: Rio Tinto 2012 Annual Report

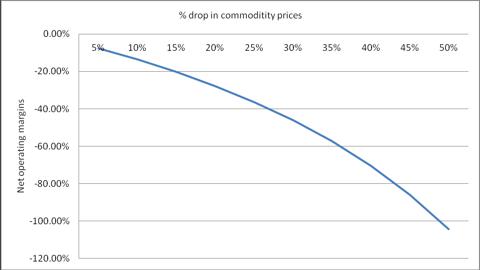

Downside potential

(click to enlarge)

Sources: Rio Tinto 2012 Annual Report

Assuming no growth in metals production, a linear decline in ore prices can actually have an exponential effect on margins. Of course this assumes that operating cost is largely invariable. As such, Rio Tinto is a great way for one to lever up on the potential price collapse.

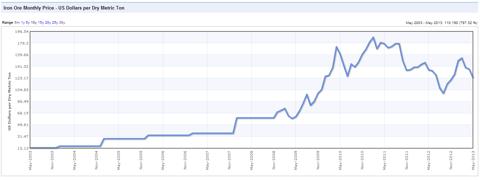

(click to enlarge)

Sources: Indexmundi.com

Just 10 years ago, iron ore was trading less than a tenth of its historical high. A material drop in ore prices is very possible.

Now, assuming Rio Tinto steps up its operations and increases volume productions, would that increase profitability? The answer is no. In fact, it would reduce it. Increasing supplies in light of declining demands would drive prices further down. At the same time, doing so would increase operating costs, squeezing operating income even more.

However, this is exactly what Rio Tinto did. It plans to kick up its production. For example, it plans to expand its iron ore production in the Pilbara region in Australia from 290 million tons to 360 million tons annually by 2015. While this is likely to be a positive for Rio Tinto in the long run, in ! the short run where a China crash may be imminent, this is a very dangerous idea.

Sources: Rio Tinto 2012 Annual Report

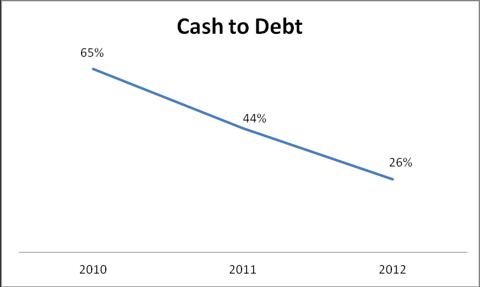

Financial position

High debt positions

Rio Tinto debt has been increasing while its cash have been dwindling. This puts Rio Tinto in a spot whereby it is especially susceptible to changes in metal prices. Large losses could further worsen the company's financial position.

(click to enlarge)

Sources: Capital IQ

Interest coverage

Due to the recent fed potential tapering, it is likely that interest rate coverage would decline, putting a strain on the company's ability to generate profits. Previously, the company increased its debt positions to take advantage of both booming china and cheap credit. Now with a much inflated debt to cash ratio, things are about to unwind.

Sources: Capital IQ

All in all

As such, I am convinced that shorting Rio Tinto is a great way to lever up on the potential China slowdown or crash. The best way may be to buy long term put options, instead of a outright short, to limit potential losses, while still having the majority of profits.

Disclosure: I have no positions in any stocks mentioned, but may initiate a short position in RIO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment