Faced with the prospects of slowing revenues and declining profits for the foreseeable future, defense contractor Northrop Grumman (NYSE: NOC ) has announced a plan to boost its earnings -- by buying back its own stock. But Northrop's hardly the only defense contractor facing a tough spending environment. And this gets an investor to wondering: Could Lockheed Martin (NYSE: LMT ) stock be next in line for a big buyback?

Where Northrop leads ...

Northrop recently upped its planned share repurchase program to $5 billion, effectively assuring investors that even if its earnings as a company should decline, it can still make its earnings per share grow.

How? Well, assume that Northrop earns (hypothetically) $1 million and divides this profit among (still hypothetically) 1 million shares. This results in $1 profit for each Northrop share outstanding. But if you shrink the share count to 750,000 -- on the same $1 million firm-wide profit -- then each remaining share owns $1.33 of the profits. Presto, change-o -- Northrop produces 33% profits growth!

... should Lockheed Martin follow?

This makes sense for Northrop, because analysts think that company's total profits will decline by about 2.6% on average over the next five years. But a 33% boost to per-share earnings could cancel out these declines and even get Northrop growing again.

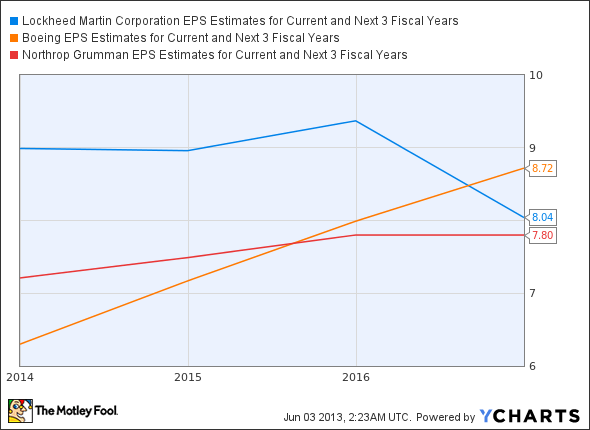

What's more, the prospect of a big buyback at Northrop is now bolstering the case for Lockheed management to undertake a similar program for Lockheed Martin stock. Why? Well consider: Up until Northrop announced its repurchase program, analysts were looking for earnings at the three big military aerospace firms to look something like this:

But now that analysts have had time to digest news of Northrop's buyback program, they predict that per-share earnings at the three firms will actually look more like this:

LMT EPS Estimates for Current and Next 3 Fiscal Years data by YCharts

See the difference? In one fell swoop, Northrop's promise of a big buyback has convinced Wall Street that the company will not just reverse its per-share earnings decline -- but actually begin growing again. Boeing's (NYSE: BA ) earnings are also expected to climb steeply -- and that leaves Lockheed Martin stock as the odd man out. Of the three big military aerospace firms, it's currently the only one that analysts now see facing a steep decline in near-term, per-share profits.

Be afraid of Lockheed Martin stock ...

It gets worse. Look now at how Lockheed Martin stock stacks up relative to the competition on free cash flow yield (that's the amount of cash profit the company generates, relative to its market cap):

NOC Free Cash Flow Yield data by YCharts

And now check out how the three firms compare when valued on the standard metric of share price-to-earnings. (Hint: Lockheed Martin stock doesn't fare well.)

... be very afraid

So just to make this picture crystal clear, let's run down the facts so far, just shifting them around a bit for emphasis:

Not to put too fine a point on it, but Lockheed is running out of "pluses" to recommend its stock to investors. It's not the cheapest defense stock out there. It is the worst cash producer. And if its earnings are projected to grow modestly in the long term, as the F-35 program scales up, then in the short term at least, the stock still compares very unfavorably with its peers.

One thing Lockheed could do to counteract this impression, though, would be to deploy its $3 billion in cash on hand, and $2.3 billion in annual free cash flow to buy back a bit of its stock. A one-year-long aggressive buyback program targeted at reducing share count by 15% could level off the near-term decline in earnings, help give investors a reason to be patient, and get them to stick around long enough to see long-term growth appear.

Boeing operates as a major player in a multitrillion-dollar defense market in which the opportunities and responsibilities are absolutely massive. However, emerging competitors and the company's execution problems have investors wondering whether Boeing will live up to its shareholder responsibilities. In our premium research report on the company, two of The Motley Fool's best minds on industrials have collaborated to provide investors with the key, must-know issues surrounding Boeing. They'll be updating the report as key news hits, so don't miss out -- simply click here now to claim your copy today.

No comments:

Post a Comment