One of the most basic algorithms we used at both Geller Capital and Surfview Capital was the intersection between high revenue growth and companies that crushed their wall street EPS estimates quarter after quarter. This combination was specifically powerful because it signaled that the market did not quite respect the ability for the company to drive incremental profit from their revenue, specifically quickly growing revenue.

Accompanying this pattern was often a disregard for how large a market or opportunity that company had in front of it. It was also usually found in a new technology, or a business that was rapidly transitioning its model, Whole Foods Market (WFM) being a good example of the latter right now.

Today, LinkedIn (LNKD) represents the former just about as well as a stock can. In early January I wrote up LinkedIn as one of the 10 stocks to own this year. Since that call, LinkedIn stock has gone from $115 to $209. I want to take a few minutes to reiterate the fundamental thesis here in a data driven way, and why I see LNKD at $300 this time next year, almost a 50% move from where it is now.

LinkedIn currently trades at about a 21 times revenue multiple. The chart below shows the range from the last year.

(click to enlarge)

Let's assume, because it's a valid assumption, that LinkedIn's price to sales ratio will hold steady at around 20 times over the next year. Yes, revenue growth is slowing, but given that it is projected to be well above the 30% YOY mark, unless the market falls apart, or they are not able to drive incremental net profit from that revenue for some insane reason, the multiple should hold true. In fact, I believe that LinkedIn's margins will only improve, but we'll touch on that later.

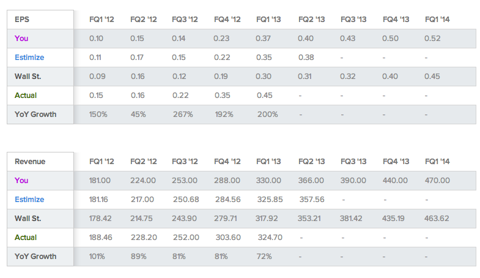

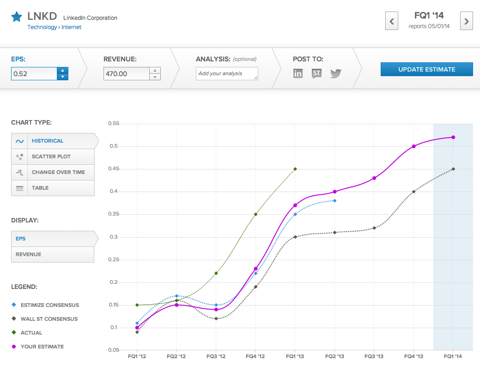

So here are my revenue estimates for the next four quarters, alongside those from Wall Street and Estimize.

My next 4 quarters YOY revenue growth rate assumptions are (60.4%, 55.2%, 44.9%, 44.8%). While it will be near impossible for LinkedIn to maintain its greater than 60% growth rate this quarter, the market will not punish it given the scale the company is achieving here. This revenue growth rate will be driven by its acquisition of recruiting customers from other competitors such as Monster.com. The company is eating the whole industry at this point. At the same time, LinkedIn has become a hub for content as well, which is beginning to rival Twitter and Facebook. Given the ability that Facebook has shown in monetizing content on mobile, which is where LinkedIn really shines these days, I would be willing to bet that drives significant revenue growth going forward.

As well, the value of the LinkedIn endorsements graph is growing exponentially as the number of endorsements grows. This is one of the most important graphs on the web, and will be used to both connect people for business purposes, as well as algorithmically surface great candidates for recruiters. LinkedIn's data science team is second to none, a difficult problem in these days of large data sets, something that Yelp has not figured out yet, but has a huge opportunity with.

Given these estimates, we can do a pretty simple calculation. At the same 20 times TTM revenue multiple, a year from now LinkedIn should be a $300 stock. What I believe could juice it even further is the margins side. Much of the value that LinkedIn will add now comes from the company's ability to wrangle its data and provide new products to its customers that add even more value. LinkedIn has done the hard work of acquiring those customers and that user base, now it has! the oppo! rtunity to sell to them.

This is why my EPS estimates are well above the street. That, and the fact that LinkedIn has a history of sandbagging its EPS estimates by a wide margin as you can see on the graph.

I will continue to update my LinkedIn model on Estimize as the next 12 months progress, but I see no reason why the revenue multiple should deviate largely from this projection. Manage risk around the broader market as this is a high beta name, but know that the fundamentals here are going to push this thing up at every step.

Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see the Disclaimer here.

No comments:

Post a Comment